RCMP Issues Alert on Sophisticated Investment Fraud Targeting Seniors

The Royal Canadian Mounted Police has released a public advisory regarding an elaborate investment scheme specifically targeting elderly Canadians across multiple provinces, resulting in devastating financial losses exceeding $15 million.

Sophisticated Operation Spans Multiple Provinces

The fraudulent investment scheme has been operating across British Columbia, Alberta, Ontario, and Quebec, with investigators identifying over 200 victims to date. The operation involves professionally designed fake investment platforms that mirror legitimate financial institutions, complete with convincing documentation and fabricated regulatory approvals.

Critical Warning Signs

Victims report being contacted by individuals claiming to represent established investment firms, offering exclusive opportunities with guaranteed high returns and minimal risk.

How the Fraud Operates

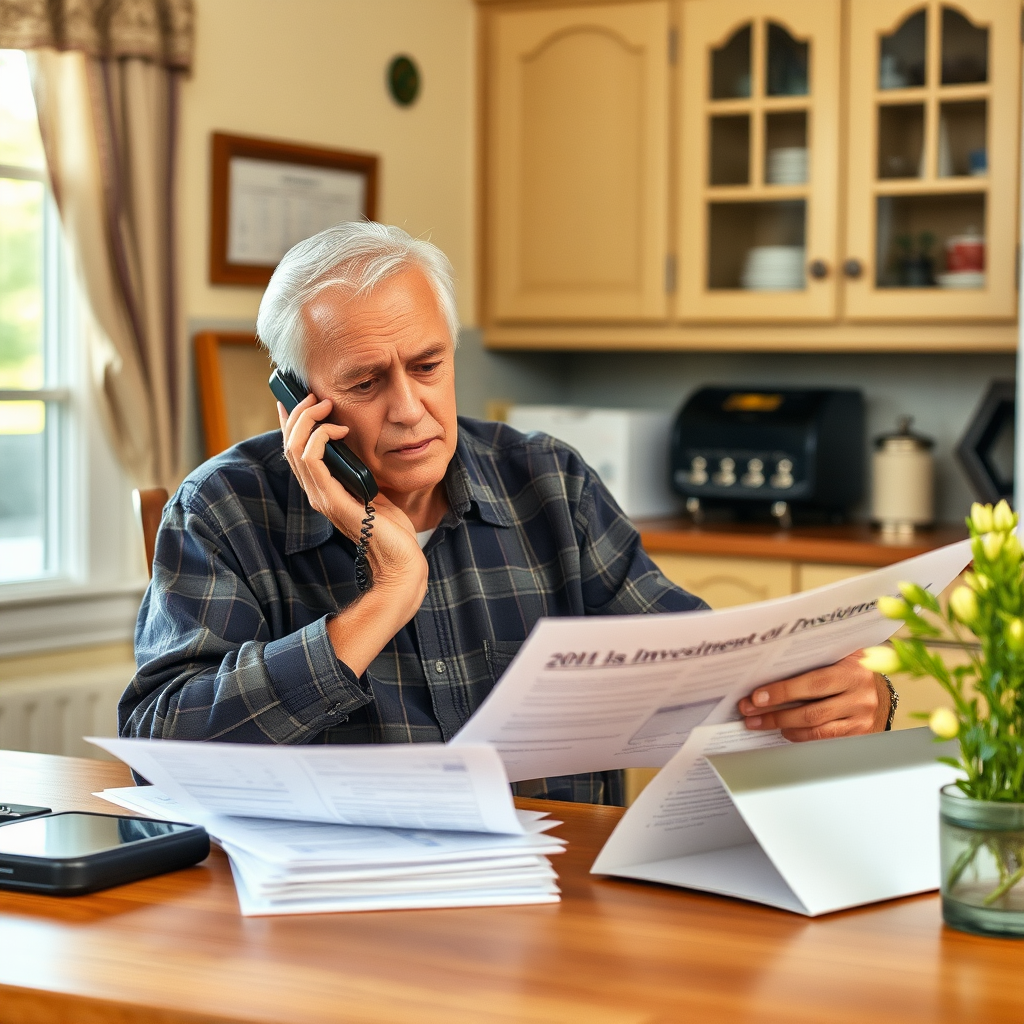

The scheme begins with cold calls to seniors, often using information obtained from data breaches or public records. Fraudsters present themselves as licensed investment advisors and provide victims with professional-looking brochures, fake regulatory certificates, and access to sophisticated online platforms that display fabricated portfolio performance.

Initial investments typically range from $5,000 to $25,000, with victims encouraged to invest more after seeing fabricated returns on their online accounts. The platforms show steady gains for several months before victims attempt to withdraw funds, only to discover the money has vanished.

Devastating Financial Impact

RCMP Sergeant Maria Rodriguez, leading the investigation, reports that individual losses range from $15,000 to over $300,000, with many victims losing their entire retirement savings. "These criminals specifically target seniors because they often have substantial savings and may be less familiar with modern investment fraud tactics," Rodriguez explained during a press conference in Vancouver.

"The psychological manipulation involved in these schemes is particularly cruel. Victims are made to feel they're making smart financial decisions for their future, only to discover they've been systematically robbed."

Red Flags and Protection Strategies

The RCMP has identified several warning signs that Canadians should watch for when approached with investment opportunities:

- Unsolicited contact offering exclusive investment opportunities

- Pressure to invest quickly or claims of limited-time offers

- Guaranteed high returns with little or no risk

- Requests for personal banking information or direct account access

- Difficulty withdrawing funds or accessing invested money

- Unregistered investment advisors or unlicensed firms

Essential Protection Steps

- Verify all investment advisors through provincial securities regulators

- Never provide banking information or passwords over the

- Consult with trusted family members or financial advisors before investing

- Research investment opportunities independently through official sources

- Be skeptical of unsolicited investment offers, especially those promising guaranteed returns

Legal Recourse for Fraud Victims

Victims of investment fraud have several legal options available, including filing complaints with provincial securities commissions, reporting to local police, and pursuing civil litigation to recover damages. Legal experts emphasize the importance of acting quickly to preserve evidence and maximize the chances of asset recovery.

Professional legal help with fraud cases can be crucial in navigating the complex process of seeking compensation for damages from fraud. Experienced lawyers specializing in fraudulent schemes can provide essential consultation on fraud matters and represent victims in court proceedings.

Ongoing Investigation and Prevention Efforts

The RCMP continues to investigate this sophisticated fraud network, working closely with international law enforcement agencies to track down the perpetrators. Several arrests have been made in connection with the scheme, though many of the primary organizers remain at large.

Financial institutions across Canada have been alerted to watch for suspicious transaction patterns associated with these fraudulent investment platforms. The Canadian Anti-Fraud Centre has also increased its outreach efforts to educate seniors about investment fraud prevention.

Reporting Suspected Fraud

Anyone who believes they have been targeted by this investment fraud scheme or similar scams should immediately contact their local police and report the incident to the Canadian Anti-Fraud Centre at 1-888-495-8501. Victims should preserve all documentation, including emails, records, and financial statements related to the fraudulent investment.

Important Reminder

Protection from fraudsters requires vigilance and education. If an investment opportunity seems too good to be true, it probably is. Always seek independent financial advice before making significant investment decisions.

The RCMP emphasizes that this investigation remains active and encourages anyone with information about suspicious investment schemes targeting seniors to come forward. Early reporting can help prevent additional victims and assist in the recovery of stolen funds.

As this case demonstrates, sophisticated fraud operations continue to evolve, making professional legal protection in case of deception increasingly important. Victims should not hesitate to seek legal help for recovery of damages from fraud and explore all available options for pursuing compensation through the court system.